How Our HSA Works

The Health Savings Account is designed to help you pay for your medical expenses, particularly to help toward your deductible. The HSA can also be used to pay for other health expenses. Both you and your parish, school or agency may make contributions to the HSA.

View the HSA guide here to learn more about your account.

View the HSA FAQ here.

Establishing Your HSA

For eligible employees, the Archdiocese will begin the process of automatically opening a HSA on your behalf with Health Equity upon your approval in the insurance enrollment process. It is your responsibility to ensure that the process is completed. Note – if you used a PO Box in your Paylocity profile, Health Equity will not open your HSA for you. You will need to provide a physical home address.

Most accounts open automatically but very few may be flagged by Health Equityat which point they would mail you a letter indicating you need to provide them with additional information. An email from Health Equity will be sent about a week after the letter is mailed. It’s important that you check your mail and email over the next couple of weeks to ensure your account is opened timely. IRS regulations do not allow for HSA funds to be used on expenses incurred prior to the account being opened. Therefore, any missed contributions will NOT be retroactively paid to you.

Employer and employee HSA funds will only be deposited into a Health Equity Account.

Employer Contributions

Your parish, school or agency makes HSA contributions as shown below (employer contributions are made each pay period while eligible):

| 2024 Coverage |

Employer Contribution (provided by Parish, School or Agency)* |

Individual Coverage

For elections which are effective in the 2024 calendar year |

$46.16 each pay period if eligible.

You only receive each contribution if you are employed, eligible for benefits and participate in the HSA at the time the contribution is made. |

Family Coverage

For elections which are effective in the 2023 calendar year |

$92.32 each pay period if eligible.

You only receive each contribution if you are employed, eligible for benefits and participate in the HSA at the time the contribution is made. |

| Maternity Management Program |

Up to $800 per covered person who participates in the program. |

| Wellness Exam |

Up to $200 per employee and spouse if both on the plan |

Your Contributions to the Health Savings Account

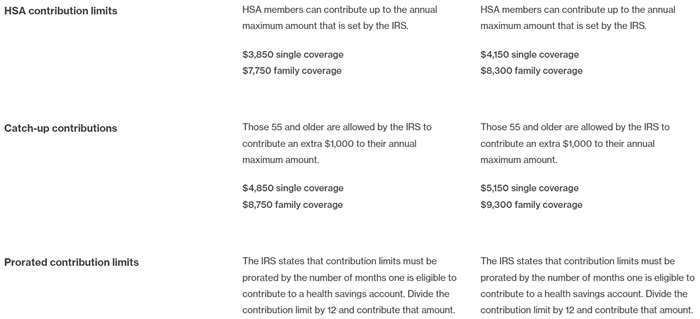

Federal regulations limit the amount that can be contributed to a HSA.

IMPORTANT: It is the responsibility of the employee to track annual contributions and balances. Any over contributions must be handled directly with Health Equity since the account is employee owned.

How to change your HSA contributions

Changing HSA contributions can only be done by the employee in the Paylocity benefits portal. Click here for instructions on how to access that portal.

Changing HSA does not require documentation or a life event.

About your HSA

Once your account is established, you will receive an HSA debit card from Health Equity. When you incur a health expense that you want to pay for using your health savings account, you simply swipe your card, sign the receipt and keep a copy of the receipt for your records.

Carry-over and Growth

Your Health Savings Account does not end or close at the end of a calendar year – it continues to accept contributions and accrue interest year after year. Your Health Savings Account earns interest that is tax-free. Upon termination, whatever funds remain in your account will be yours to keep.

Available Funds

If you use your HSA debit card to pay for your expenses and your expense is greater than your available funds, your expense will be denied. In these cases you can pay the expense and then reimburse yourself when your Health Savings Account balance will cover it. Or, you can ask the provider if they will accept payments in installments.

Qualified Expenses

While the money in your account is intended to cover your deductible, you may also use it to pay for other health expenses.

In general, qualified expenses include medical, dental and vision expenses that are not covered by insurance. Some examples that count toward your deductible and may be paid from your account are your expenses for prescription drugs, doctor’s office visits, inpatient or outpatient services, laboratory and diagnostic testing. Please see Allowable Expenses for a complete listing.

You may also pay for dental procedures (fillings, extractions, root canals, etc.) and vision care (glasses, contacts, etc.) using your Health Savings Account. And, you may use your HSA to pay for adult orthodontia, corrective vision surgery, hearing aids, orthopedic shoes when medically necessary, and over-the-counter drugs. (Prescriptions for over-the-counter drugs are required). However, these expenses do not count toward your medical plan deductible.

For more information on qualified expenses, click here for IRS Publication 502.

Issues to Consider

If you expect to meet your deductible during the calendar year and also incur the 30% co-insurance on some medical care, you may need to save for these additional expenses using other means (see Health Care Flexible Spending Account).

Save your receipts as well as any paperwork you receive from the insurance company. If you pay for non-qualified expenses using your health savings account, you will be liable for taxes on the amount of the withdrawal plus a 10% penalty.

Save money by using in network providers for medical, prescription and dental services.

Medicare and VA Benefits

Federal regulations prohibit employees enrolled in Medicare or receiving VA benefits from participating in a Health Savings Account. However, we can set up a Health Reimbursement Account for you. Click here for more on the Health Reimbursement account.

Employees may contribute to the Health Care Flexible Spending Account for persons not contributing to a HSA. Click on Flexible Spending Accounts to learn more.